GRAMMATICAL PECULIARITY OF FISHERMEN LANGUAGE AT TRIVANDRUM

June 30, 2022EFFECT OF PSYCHO-EDUCATION ON CREATING AWARENESS OF EMOTIONAL ABUSE

June 30, 2022GRAMMATICAL PECULIARITY OF FISHERMEN LANGUAGE AT TRIVANDRUM

June 30, 2022EFFECT OF PSYCHO-EDUCATION ON CREATING AWARENESS OF EMOTIONAL ABUSE

June 30, 2022Sparkling International Journal of Multidisciplinary Research Studies

MAKE IN INDIA A SECONDARY ANALYSIS

* Sheela, M. C., & **Kaveya, P.

*Associate Professor, Department of Economics, University College, Trivandrum, Kerala, India.

**Ph.D. Research Scholar, Department of Economics, University College, Trivandrum, Kerala, India.

Abstract

On September 24, 2014, Prime Minister Mr.Narendra Modi announced the Make in India initiative. The program’s goals were to expand domestic manufacturing in India and draw foreign direct investment into the country’s economy. The Indian government considered this project to be urgently needed to lure entrepreneurs who were leaving the nation. Due to India’s poor rating for how easy it is to start and operate a business, it has been discovered that entrepreneurs relocate there to do business. The primary goal is to increase the manufacturing sector’s contribution to GDP to 25%.

Keywords: make, india, analysis, business, economy.

Introduction

On September 24, 2014, Prime Minister Mr. Narendra Modi announced the Make in India initiative. The program’s goals were to expand domestic manufacturing in India and draw foreign direct investment into the country’s economy. The Indian government considered this project to be urgently needed to lure entrepreneurs who were leaving the nation. Due to India’s poor rating for how easy it is to start and operate a business, it has been discovered that entrepreneurs relocate there to do business. The main goal is to increase manufacturing’s GDP contribution to 25%.

In order to achieve its goal of greatly increasing job prospects in India, luring investment, and elevating Indian manufacturing sectors to the top of the global manufacturing industries. The Indian government is making serious moves, such as creating specialised cells, restructuring 25 sectors of the Indian economy, and deregulating industrial policy.

This study focuses on the impact of “make in India” on the Indian economy’s pharmaceutical and defence manufacturing industries. The government of India started the Make in India initiative, a sort of Swadeshi movement that spans 25 economic sectors, on September 25, 2014 in an effort to entice businesses to boost their investment and produce their goods in India. According to the current policy, all 25 sectors are open to 100% Foreign Direct Investment (FDI), with the exception of space (74%), defence (49%) and news media (26%).

Objective of the Study

- To learn about the central government’s “Make in India” economic growth plan.

- To be aware of the measures the federal government has developed in the pharmaceutical and defence industries to boost domestic manufacture.

- To research how these policies affect various sectors.

- Understanding the difficulties of a campaign for future economic progress as a responsible citizen.

Scope of the Study

Make in India, launched in 2014, aims to attract businesses to manufacture goods in India and boost investment. It targets 25 sectors, allowing 100% FDI in most industries except space, defence, and media. Japan and India have also established a special finance facility of US$12 billion to encourage investment.

Between September 2014 and February 2016, India got promises for investments totalling 16.40 lakh crore (US$230 billion) and queries for investments totalling 1.5 lakh crore (US$21 billion) after the launch. As a result, with US$60.1 billion in FDI, India surpassed the USA and China to become the top destination for FDI globally in 2015.

Several states, like Vibrant Gujarat, Happening Haryana, and Magnetic Maharashtra, established their own versions of the Make in India programme. India attracted FDI worth $60 billion in the fiscal year 2016–17.

By the end of 2017, India has improved in all three of these categories, moving up 32 spots on the World Economic Forum’s global competitiveness ranking and 19 spots on the Logistics Performance ranking.

Other significant Government of India initiatives, including Bharatmala, Sagarmala, Dedicated Freight Corridors, Industrial Corridors, UDAN-RCS, Bharat Broadband Network, and Digital India, are brought together, made more effective, and made possible by this programme.

Methodology and Data Source

Methodology adopted in this project is secondary data.

Limitation of the Study

The field of research is constrained because the data collection process in this case solely uses secondary data collection methods. The success of a project is determined using reports from numerous institutes as a framework. As a result, the degree of success in diverse areas will vary somewhat. The study only focuses on how it affects the biotechnology and defence industries.

Make in India

Make in India is a government initiative launched with several objectives in mind. First, it aims to stimulate employment growth across 25 different economic sectors. Second, it strives to enhance skills within these sectors, ensuring a competent workforce. Third, the initiative seeks to establish India as a global hub for design and manufacturing, attracting international attention. Fourth, it aims to strengthen the tertiary and secondary sectors of the economy. Fifth, Make in India emphasizes the utilization of India’s human resources to create high-quality, defect-free products. Moreover, the initiative aims to attract foreign investment, contributing to the growth of the economy. Lastly, Make in India emphasizes the importance of preserving property rights, ensuring a favourable business environment. By pursuing these objectives, Make in India aims to transform India into a prominent player in the global manufacturing landscape. The mission of the project is to manufacture in India and sell the product worldwide.

Make in India

15% of the nation’s GDP is currently contributed by manufacturing. By producing 100 million jobs by 2022, the campaign hopes to increase its contribution to 25% and address the issue of unemployment. India had dropped to the 134th spot out of 189 nations in terms of business ease. The goal of this effort is to improve India’s standing.

Prerequisites for “Make in India”

- Having a low inflation regime with predictable and consistent policy is the first and most crucial precondition for India.

- A successful “make in India” campaign lacks two essential components due to high inflation:

- Capital accumulation

- The rate at which productivity is changing

- “Make in India” investors would need policy stability with regard to trade levies, such as import, export, and taxation, in addition to inflation.

What actions has the government made to advance the “Make in India” initiative?

- Industrial licence and industrial entrepreneur’s memorandum applications can be made online, 24 hours a day, seven days a week, through the e-Biz platform.

- The industrial license’s three-year expiration date was increased.

- Major defence product list components are not eligible for industrial licencing.

- Items with dual uses that have both military and civilian purposes were deregulated.

- By the end of 2014, all central government departments and ministries have connected their services with the e-biz IT platform for services.

- Online application for environmental approval.

- Steps were established for filing every return online using a single form.

- The ministry’s web portal should have a check list of necessary compliances.

Foreign Direct Investment

- 100% FDI is permitted in the telecom sector.

- A single brand retail with 100%FDI.The government route for FDI in commodity exchanges, stock exchanges and depositories, power exchanges, and petroleum refining by PSU courier services has now been replaced by the automatic route.

- The lifting of restrictions in the tea planting industries.

- Increased FDI ceilings to 74% for credit information and 100% for asset rehabilitation firms. The 26% FDI cap in the defence sector was lifted to 49% with government approval.

- Under the automated route, foreign portfolio investments up to 24% are allowed. On a case-by-case basis, FDI over 49% is also permitted with the cabinet committee on security’s blessing.

- The railway industry opens to 100% FDI under an automated route for specified activities including construction, operation, and maintenance.

The current situation in the Indian defence sector

- India imports 60% of its armaments from foreign nations, ranking third in the world in terms of the number of active military personnel. It is the biggest weaponry importer in the world and is responsible for 14% of all imports.

- India imports a lot of conventional defence gear and devotes roughly 40% of its overall defence budget to capital purchases.

- As the sole purchaser of defence equipment, the government spends considerably, with defence spending making up nearly to 15% of Central Government spending.

- The government hardly makes any investments in R&D. The amount of defence spending that is allocated to research is only 6%.

Make in India and the value it plays in the defence sector

The Make in India program prioritizes indigenization by encouraging the growth of Indian businesses and providing cost benefits for the production of design services, components, and assemblies. The focus on research and development in the indigenous military sector and civil aircraft is crucial once local manufacturing is established. The program aims to facilitate the design and manufacture of cutting-edge technological solutions, including advanced armour, remote weapon systems, and missile technology. By attracting international enterprises, the goal is to promote investment, entrepreneurship, and technological advancements for economic growth. The defence sector allows 49% FDI, leading to collaborations with Indian firms that enhance technical capabilities. The SME sector plays a vital role in employment and GDP contribution. With significant investments in defence modernization, India becomes an attractive location for defence-related firms. The program seeks to boost private sector participation, which has been limited thus far.

Presentation of statistics

Defence platforms, tools, and spare parts produced in India and shipped abroad for FY 2015–16 totalled INR 2,059.18 crore. Patrol vessels, Helicopters and their spare parts, Sonars and Radars, Avionics, Radar Warning Receivers (RWR), Small Arms, Small Calibre Ammunition, Grenades, and Telecommunication equipment are a few of the major defence items that Defence Public Sector Undertakings (DPSUs) and Ordnance Factory Board (OFB) export. The three-year defence export performance is as follows:

- 2012-13:46097 crore

- 2013-14:68627crore

- 2014-15:99404crore

- 2015-16:205918 crore

A Definitive Analysis of Defence Manufacturing

FDI Policy

In the defence sector, 100% FDI is permitted, of which up to 49% is allowed through an automatic method. On a case-by-case basis, FDI above 49% is allowed through the government channel where it is likely to lead to access to new technologies. DPSUs have been given permission to export up to 10% of their annual production for products where there is a capacity restriction in order to investigate export market potential.

Fiscal Incentives

Budget 2017–18 witnessed a 6.2% increase in the defence budget, with a significant allocation of INR 86,488 crore for defence capital. To create a level playing field, preferential treatment for Defence Public Sector Undertakings (DPSUs) in excise and customs duty has been withdrawn, applying the same assessments to all Indian enterprises. The Indian private sector now receives exchange rate variation protection equivalent to PSUs for capital acquisitions. The exemption from customs duties on defence equipment imports has been removed to encourage both imports and domestic production. These measures aim to strengthen the defence sector and ensure fairness in procurement processes.

Ease of Doing Business

Make in India allows foreign vendors flexibility in selecting Indian Offset Partners (IOPs) and offset specifics. Fast-tracking procurements have shorter validity periods. Transparency is ensured with a list of eligible military outlets for NOCs. Restrictions on equity ownership and transfer lock-in terms for FDI in defence are eliminated. Simplified procedures and deadlines streamline NOC issuance for military supplies export. “In principle” permission encourages Indian businesses to explore foreign markets. These measures boost efficiency, transparency, and export potential in the defence sector.

Skill Development

As part of the Skill India project, the promotion of National Skills Qualification Framework (NSQF) compliant skill training is underway. Modernization of training facilities in eight ITIs has been initiated, with spare and functional equipment donated by OFB/DPSUs for training purposes. Additionally, the percentage of trainings under the Apprenticeship Act has increased from 2.5% to 10% of the strength at OFB/DPSUs.

Importance of “Make in India” in the defence industry

Since gaining independence, the need for self-sufficiency has driven India to develop and broaden its defence industry base. The majority of India’s defence facilities and tools were left over from her former colonial master, Britain, in 1947. India concentrated on developing its capacity to manufacture basic equipment domestically throughout the 1950s, importing more complex equipment to meet its needs. The arms and ammunition industry was designated to the public sector by the 1956 revision of the Industrial Policy Resolution. The Defence Research and Development Organisation (DRDO) was established in India in 1958.

India’s defence industry gained momentum after setbacks with China in 1962. Defence spending increased from 1.5% to 2.3% of GDP. The Soviet Union supplied India with most of its defence hardware. India’s decision to develop its own fighter systems in the 1980s led to indigenization efforts. The Brahmos cruise missile was developed through a partnership with the Soviet Union in 1998. The Make in India project further advanced indigenous production and attracted foreign investment.

Highlights of the project “Made in India”

- Israel Aerospace Industries Wins $630 Million Missile Contract with the Indian Navy An additional $630 million deal to provide air and defence missile systems for four Indian naval ships has been awarded to the state-owned Israel Aerospace Industries. In accordance with India’s “Make in India” initiative, the contract was executed with Bharat Electronics Ltd., who also serves as the project’s principal contractor.

- Indian Navy Signs Deal with Tata Power SED for Portable Diver Detection Sonar (news on november17, 2017) Indian Navy to acquire Portable Diver Detection Sonar from Tata Power SED, enhancing underwater surveillance. Supports ‘Make in India’ initiative. Contract falls under ‘Buy and Make’ category.

Critics’ Concerns

- Social Sector Programs: Critics argue that focusing on Make in India may divert resources from important social sector programs, potentially impacting the welfare of the population.

- Comparative Advantage: Some critics question the approach of Make in India, as it encompasses a wide range of industries instead of targeting specific sectors based on comparative advantage. This approach may spread resources too thin.

- Geopolitical Concerns: India’s economic power raises concerns about its potential influence in international geopolitics, leading to cautious responses from other nations.

- Potential Conflict with China: As India’s economic growth challenges China’s dominance in the region, critics argue that there could be negative consequences, as seen in events like the Doklam Issue and the China-Pakistan Economic Corridor (CPEC).

- Crony Capitalism: Critics express concerns about the potential rise of crony capitalism, where close relationships between business and government could lead to unfair advantages and hinder a level playing field for all businesses.

- Carbon Emissions: The increased industrial activity under Make in India may lead to a rise in carbon emissions, making it more challenging for India to meet its Intended Nationally Determined Contributions (INDCs) for the Climate Change Paris Summit.

Challenges to Project

- Financial challenges: India’s industrial development and infrastructure face funding constraints, primarily due to bad loans in the corporate sector, hindering significant investments. FDI has limitations in addressing this issue.

- Automation impact: Legacy protectionist regulations and the potential rise of automation pose difficulties in finding skilled workers for the manufacturing sector. The threat of job displacement by robots necessitates addressing the implications for Indian laborers.

- R&D investment: To sustain competitiveness, increased investments in research and development (R&D) are crucial. While some multinational corporations have established R&D centers in India, local businesses need to embrace R&D practices and enhance coordination with organizations like CSIR.

- Skills gap: India lags behind in providing industry-specific technical skills training to its workforce. Efforts by NSDC are underway, but there is a need to further bridge the gap and improve the availability of shop floor technical skills aligned with industry requirements.

Challenges

In addition to the difficulty of competing with nations like China, Korea, and Malaysia, the Indian pharmaceutical industry also faces the following difficulties:

Drug Quality: India is addressing the issue of fake pharmaceuticals by modernizing drug testing facilities, implementing advanced technology, serialization, non-cloneable packaging, and hiring more inspectors.

Quality of Clinical Trials: To regulate clinical trials and promote ethical practices, the Indian government has established the Dr. Ranjit Roy Chaudhury expert committee, whose recommendations are being implemented.

Market Drug Pricing Practices and Patent Issues: The Health Ministry’s drug pricing policies and promotion of generic drugs have raised concerns among multinational corporations regarding India’s viability for clinical trials due to high medication costs and the focus on generic products.

The Indian Government had taken many measures to address the problems and support the Indian Pharmaceutical Industry. The “Make in India” Campaign is one such initiative.

Investments in the Sector are Rising

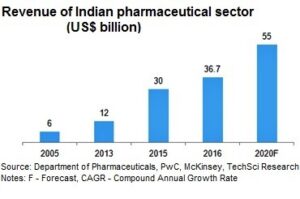

India’s pharmaceutical market has grown rapidly, with a CAGR of 17.46% from 2005 to 2020, reaching US$55 billion. It is expected to rank among the top three global markets by 2020. India’s competitive advantage lies in its lower production costs compared to the US and Europe, attracting investments and boosting its position in the industry.

Result Projections

India’s pharmaceutical sector is poised for remarkable growth, projected to contribute 10% of global volume and 3.6% of value by the end of 2016. The healthcare market is also set to expand from USD 65 billion to USD 250 billion by 2020, with the generics market expected to reach USD 26.1 billion by the end of 2016. These trends position India as a key player in the global pharmaceutical and healthcare industries.

Cost Effectiveness and Competitiveness are Still India’s Pillars

India’s cost advantages, including lower labor expenses and manufacturing costs, make it an attractive destination for businesses. The cost of setting up production facilities in India is also significantly lower than in Western nations. These advantages create opportunities for Indian businesses, especially in developing nations and Africa, due to their cost-effectiveness.

Foreign Direct Investment (FDI) Policy and Export Incentives: Empowering Make in India Campaign

Make in India allows 100% FDI for Greenfield projects and up to 100% FDI in brownfield projects with government approval. Non-compete agreements are generally not allowed. Export incentives target various strategies and sectors to boost economic growth.

State Incentives

In addition to the aforementioned, each state in India provides additional incentives for industrial projects. These include reduced land costs, lowered stamp duties on land sales and leases, power tariff incentives, reduced loan interest rates, investment subsidies/tax incentives, subsidies for underdeveloped areas, and special incentive packages for megaprojects, among other things.

R&D Benefits

Any amount paid to a national laboratory, university, or institute of technology is allowed a weighted deduction of 200%. For both capital and revenue expenditures incurred for scientific research and development, the Income Tax Act allows a weighted tax deduction of 150%.

In Hyderabad, a national centre is being established to aid in the development of bulk medications and to support their research. Reference standards for pharmaceuticals may be imported duty-free.10% tax credit on income earned abroad as a result of patents for products produced in India.

Make in India: Pharma Entrepreneurs Urge Industry to Address Compliance Issues

Leading pharmaceutical entrepreneurs in India have urged the industry to address regulatory compliance issues to establish India as a producer of high-quality medications. The US FDA has issued warning letters to six pharmaceutical companies with operations in India, reflecting the need for adherence to strict cGMP standards. Major Indian pharmaceutical firms, such as Wockhardt and Sun Pharma, have been grappling with compliance challenges. This has had an impact on the market capitalization of the top five pharmaceutical companies in India, with a significant decrease observed in November 2015. The import alerts and warnings from the US FDA regarding manufacturing facilities of these companies have contributed to the decline in stock value.

Shift from generic drugs to innovations

- Get out of the role of being generic players. To innovate and seize the potential $800 billion medicines market, India must go beyond its borders.

- Changing the curriculum in schools is suggested: Fix the pharmacy college curricula in India, where many of the current issues facing the pharmaceutical industry, like data integrity, are not given primary emphasis.

Abolishing Price Control

The National Pharma Pricing Authority regulates drug prices for medications listed on the National List of Essential Medicines, with 348 medications subject to price control under the Drug Price Control Order. The pharmaceutical and healthcare sectors are expected to create around 134,000 new jobs, driven by government investments. The Indian pharmaceutical market is projected to reach US$100 billion by 2025, supported by factors such as rising consumer expenditure, urbanization, and healthcare insurance costs. The industry emphasizes the quick entry of generic medications, preventive immunizations, life-saving drugs, and rural health programs. To facilitate sector expansion, sufficient foreign direct investment (FDI) and its spill-overs are crucial.

Conclusion

The Indian government has designated 25 key areas for the Make in India initiative that would receive appropriate promotion. These are the industries with the highest likelihood of FDI (foreign direct investment), and the Indian government would actively encourage investment in these fields. At the beginning of his campaign, Prime Minister Mr. Modi stated that the growth of these industries would ensure that people from around the world would travel to Asia, especially India, where the availability of both democratic conditions and superior manufacturing made it the best destination, especially when combined with the effective governance that his administration intended. India has abundant natural resources. Given the high unemployment rates among the country’s educated class, skilled labour is readily available and in plentiful supply. India will soon overtake Asia as the preferred manufacturing location for most foreign investors as Asia emerges as the global centre for outsourcing. Mae in India is an initiative by the Indian government to take advantage of this demand and advance the Indian economy.

The Make in India campaign faces hurdles as India ranks poorly on the ease of doing business index and lacks supportive labor regulations. China’s Make in China movement poses strong competition for India in outsourcing, manufacturing, and services. Outdated infrastructure and logistics systems hinder India’s industrial growth, leading to delays and inefficiencies in production. The Modi administration aims to address these challenges and transform India into a favorable business destination. Despite attracting investment proposals, critics argue that policy and labor reforms are essential for the campaign’s success. Concerns over layoffs and technology-based businesses continuing to source components from China have also been raised.

References

Department for Promotion of Industry and Internal Trade. (n.d.). Investment Promotion. Retrieved from https://dp iit.gov.in/programmes-and-schemes/industrial-promotion/investment-promotion

India Brand Equity Foundation. (n.d.). Make in India. Retrieved from https://www.ibef.org/economy/make-in-india

Make in India. (n.d.). Retrieved from https://www.makeinindia.com/

Prime Minister’s Office, Government of India. (n.d.). Make in India. Retrieved from https://www.pmindia.gov.in/en/major_initiatives/make-in-india/

The Financial Express. (n.d.). Make in India. Retrieved from https://www.financialexpress.com/about/make-in-india/

To cite this article

Sheela, M. C., & Kaveya, P. (2022). Make in India a Secondary Analysis. Sparkling International Journal of Multidisciplinary Research Studies, 5(2), 12-22.